Global Filters for Efficient Analysis and Reporting

In the world of data-driven decision-making, having efficient and streamlined reporting processes is essential. Acknowledging this demand, we are thrilled to introduce our latest innovation: Global Filters.

This feature allows users to create and apply custom filters across multiple reports within the Your Bourse platform for the day to day business intelligence and regulatory reporting, saving time and ensuring consistency.

What are Global Filters and how do they work?

Global Filter functionality allows users to create custom reporting templates on both user and organisation levels. The templates are saved under the profile and can be applied to any Your Bourse reports including the Trade blotter - providing the full access to the Your Bourse Data Warehouse.

What sets this feature apart from any competitors' functionality is the possibility of an API-based connectivity to the Data Warehouse and the Trade Blotter. That includes all the data on MT4 Bridge/MT5 Gateway, Matching Engine and LP. The data can be accessed via the Cloud Portal or an open API. The data can be received in real time or historically, depending on the dealer's needs and preferences. By using Global Filters, users can avoid any extra integration work from Your Bourse.

Users can create a Global Filter that includes a specific group of clients, symbols, time range, and other criteria. Then, they can apply this filter to any report they want with a single click, without having to set up the same parameters again and again.

Users can also modify and update their Global Filters at any time, and the changes will be reflected in all the reports that use them. This way, users can adjust their filters according to their needs and preferences, without affecting the individual reports.

Why use Global Filters?

Global Filters offer several benefits for users who want to streamline their reporting workflow and get consistent data for analysis and decision making. Some of the key benefits are:

- Streamlining: Users can generate multiple pre-configured filters and apply them to various reports effortlessly with a single click. It simplifies the reporting workflow significantly, eliminating the need to set up different filters repeatedly.

- Dynamic Management: Users can easily modify and update their Global Filters, allowing them to adjust the settings without affecting the individual reports.

- Consistency - Company wide filters: By applying the same filter across multiple reports, users can ensure getting data for analysis and reporting consistently, ensuring including all the preset in Global filter parameters.

Global Filter Use Cases

Global Filters can be used for different purposes and scenarios, depending on the user’s goals and needs. Here are two examples of how Global Filters can be used in practice.

Global Filters for the daily analysis and decision making

Users can use Global Filters to filter, export and analyse the data for a certain group of clients for a particular broker, for the aims of creating a new marketing campaign, extension to the new markets, cutting costs, increasing profitability, etc. For example, users can create a Global Filter that includes clients from a specific region, with a certain trading volume, account type, or earning power. Then, they can apply this filter to various reports, such as client activity, revenue breakdown, symbol performance, etc., and get insights into their target market segment.

A Step-by-Step Guide

If a broker wants to analyse the performance of his specific clients group, he can use Global Filters to easily filter out the data needed.

For instance, Broker X has a large number of clients who trade with MT4 and MT5. These clients come from various countries from around the world and have different levels of status (segmentation) and trade different currencies.The broker wants to filter by single country so an example of this is that the broker wants to examine the performance of their Chinese clients between MT4 and MT5, and determine whether to initiate a new marketing campaign, enter new markets, reduce costs, etc.

On MT5 Server, the broker has Chinese clients in the groups: real\SH\PROF\CN_USD, real\SH\VIP\CN_USD, real\UK\PROF\CN_USD, and real\UK\VIP\CN_USD.

On MT4 Server, the broker has Chinese clients in the groups: SH_VIP_CN_USD, UK_VIP_CN_USD, SH_PROF_CN_USD, and SH_VIP_CN_EUR.

The broker can set up the Global Filter to easily filter out the Chinese clients in such a way:

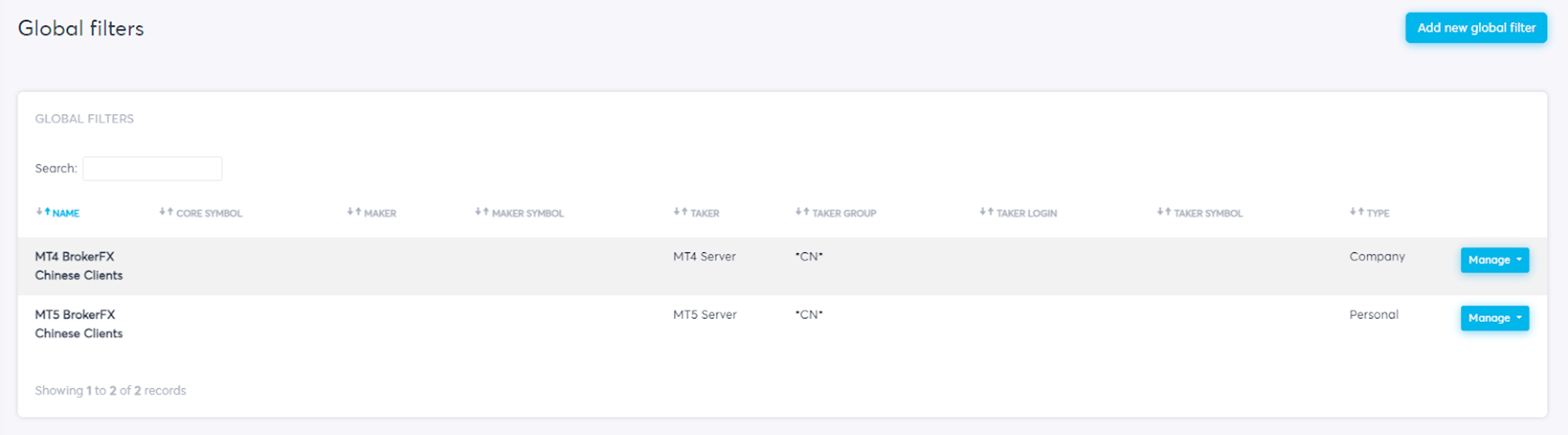

- Go to the Settings menu and select Global Filters.

- Click on the Add button to create a new Global Filter.

- Give a name and description to the new Global Filter, such as “MT4 BrokerFX Chinese Clients” or “MT5 BrokerFX Chinese Clients”.

- Select the parameters that he wants to include in the filter, such as groups, symbols, time range, etc. In this case, select the groups that contain “CN” (that means Chinese clients) in their name.

- Save the new Global Filter.

To see how the Global Filter works in Trade Blotter, follow these steps:

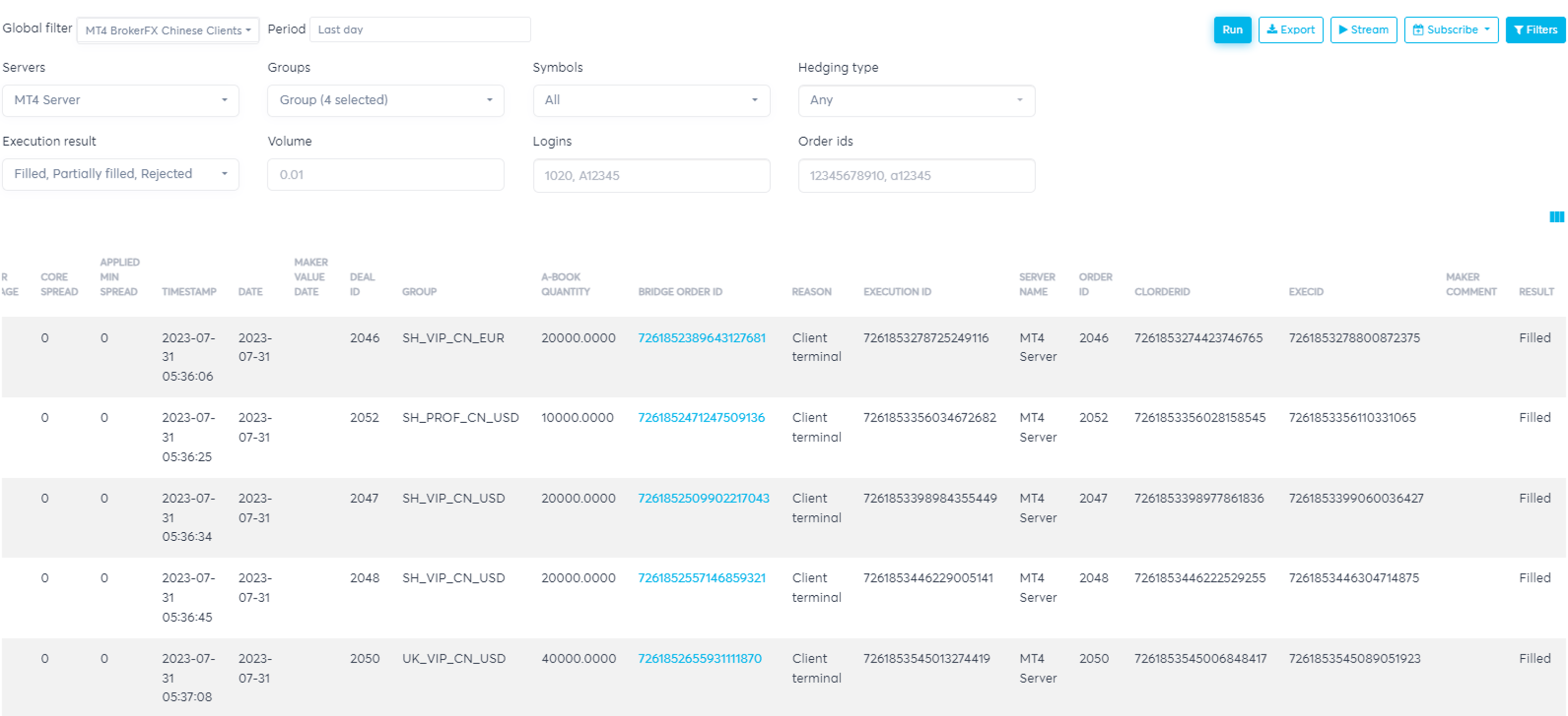

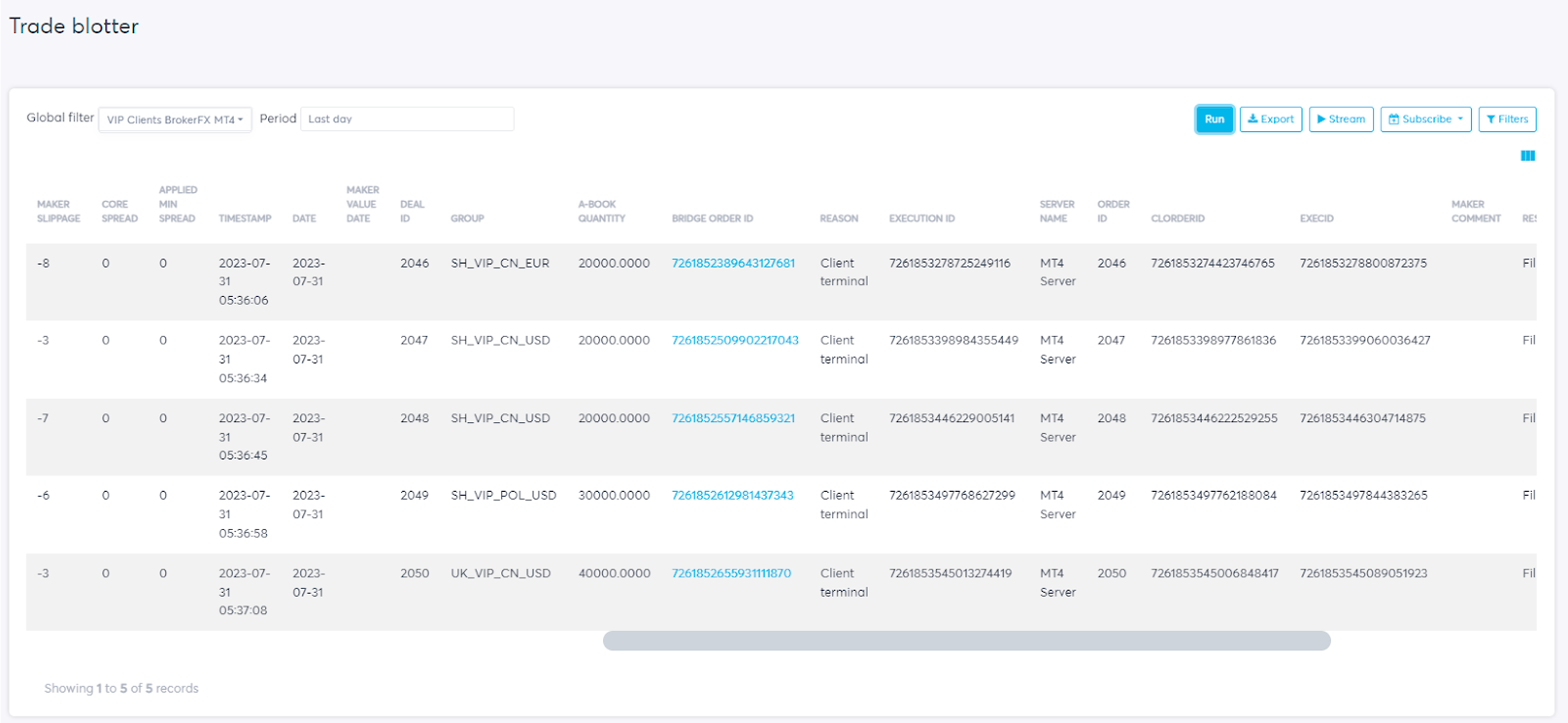

- Go to the Monitoring section and select Trade Blotter.

- On the page, select the Global Filter that you want to use from the drop-down list, such as “MT4 BrokerFX Chinese Clients” or “MT5 BrokerFX Chinese Clients”.

- Click on the Run button.

The Trade Blotter will return all the trades that were done by the accounts in the selected groups.

You can see that all the trades came from the MT4 Server. If you select “MT5 BrokerFX Chinese Clients”, you will see all the trades from the Chinese accounts for MT5.

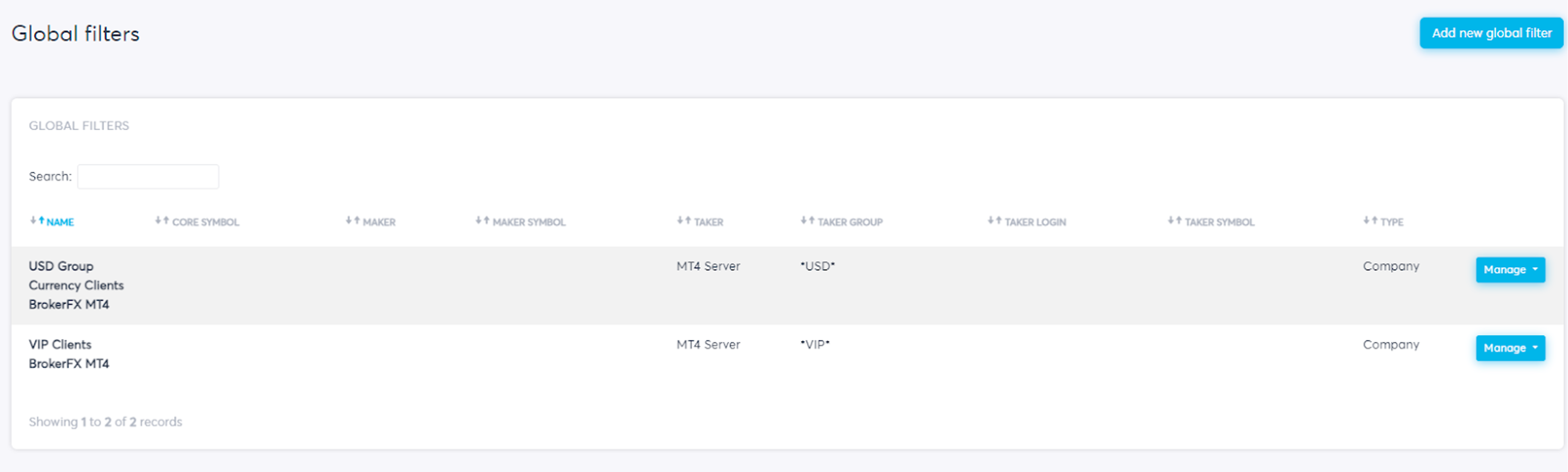

In the same way, you can create filters to show only VIP clients that have USD as a group currency. For example:

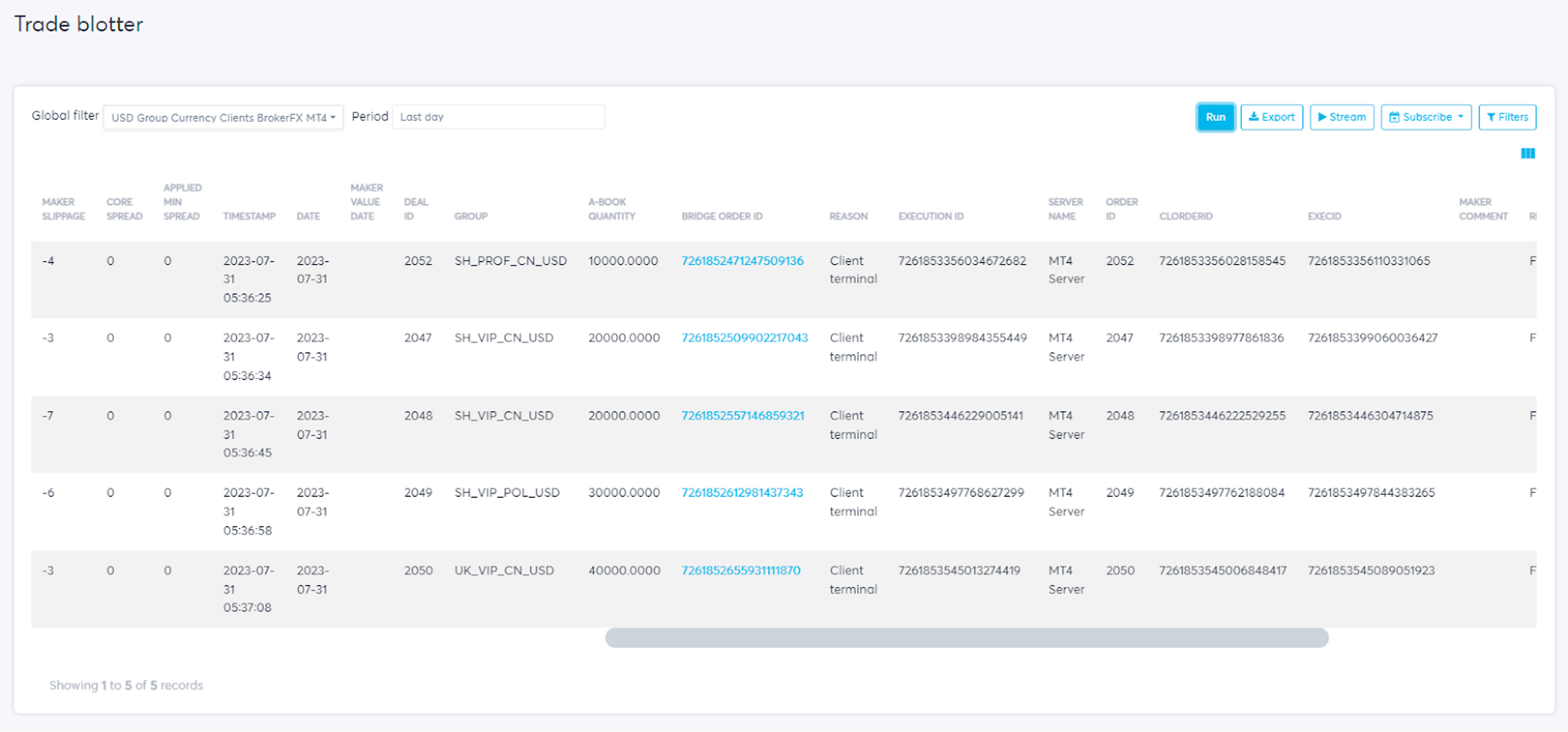

Then you can return to the Trade Blotter, choose the Global Filter “USD Group Currency BrokerFX MT4” and get the correct results.

Similarly, if you choose the Global Filter “VIP Clients BrokerFX MT4”, you will have the results for only VIP clients.

Brokers can also mix and match the group filters: for example, you can filter by VIP clients who have USD as their group currency, and so on.

Then you can easily export or schedule to email or via SFTP this data for further analysis and decision making.

Global Filters for regulatory reporting

Users can use Global Filters to create and automatically send reports to regulators or special companies that prepare these reports for regulators. For example, users can create a Global Filter that includes all the required parameters for regulatory reporting, such as client identification, transaction details, risk exposure, etc. Then, they can apply this filter to the relevant reports, such as trade history, margin report, risk report, and schedule them to be sent automatically on a regular basis (daily, weekly, monthly).

A Step-by-Step Guide

For instance, Broker X has many clients who trade with MT4 and MT5, offering trading and brokerage services to both corporate and individual clients. This broker is registered in Poland and needs to report to the European Securities and Market Authority (ESMA).

According to the law, the broker has to send an EMIR (European Market Infrastructure Regulation) report to the regulator ESMA, which also works in Poland and uses the intermediary company RegulTech that prepares these reports for him based upon the daily trades. However, in the case of EMIR, the broker needs to send only the derivatives' trades and not the regular financial instruments. Likewise, this broker has to send those reports daily simultaneously.

To make this process easier, the broker can use the "Global Filters "and schedule reports on the YourBourse platform. Global Filter feature allows to filter only those symbols and MetaTrader groups (as well as other components) that the broker needs to automatically send to the intermediary company that prepares reports for the regulatory agency.

For example, the broker needs to filter out and send the data for all clients and trades who trade derivatives. On the MT5 Server broker has these clients in the groups: real\PL\DER\USD, real\PL\DER\EUR, real\PL\RI\USD, real\PL\RI\EUR. The first two groups consist of the accounts that trade derivatives, while the latter two include accounts making orders of the regular instruments.

On the MT4 Server, the broker has Polish clients in the groups PL_DER_USD and PL_RI_USD. Accounts in the first group trade derivatives, while in the second - regulator instruments.

The broker can set up the Global Filter to quickly filter out the Polish clients in such a way:

- Go to the Settings menu and select Global Filters.

- Click on the Add button to create a new Global Filter.

- Give a name and description to the new Global Filter, such as "EMIR Report Derivatives."

- Select the parameters he wants to include in the filter, such as groups and symbols. In this case, select the groups with "DER" (the derivative instruments) in their name.

- Save the new Global Filter.

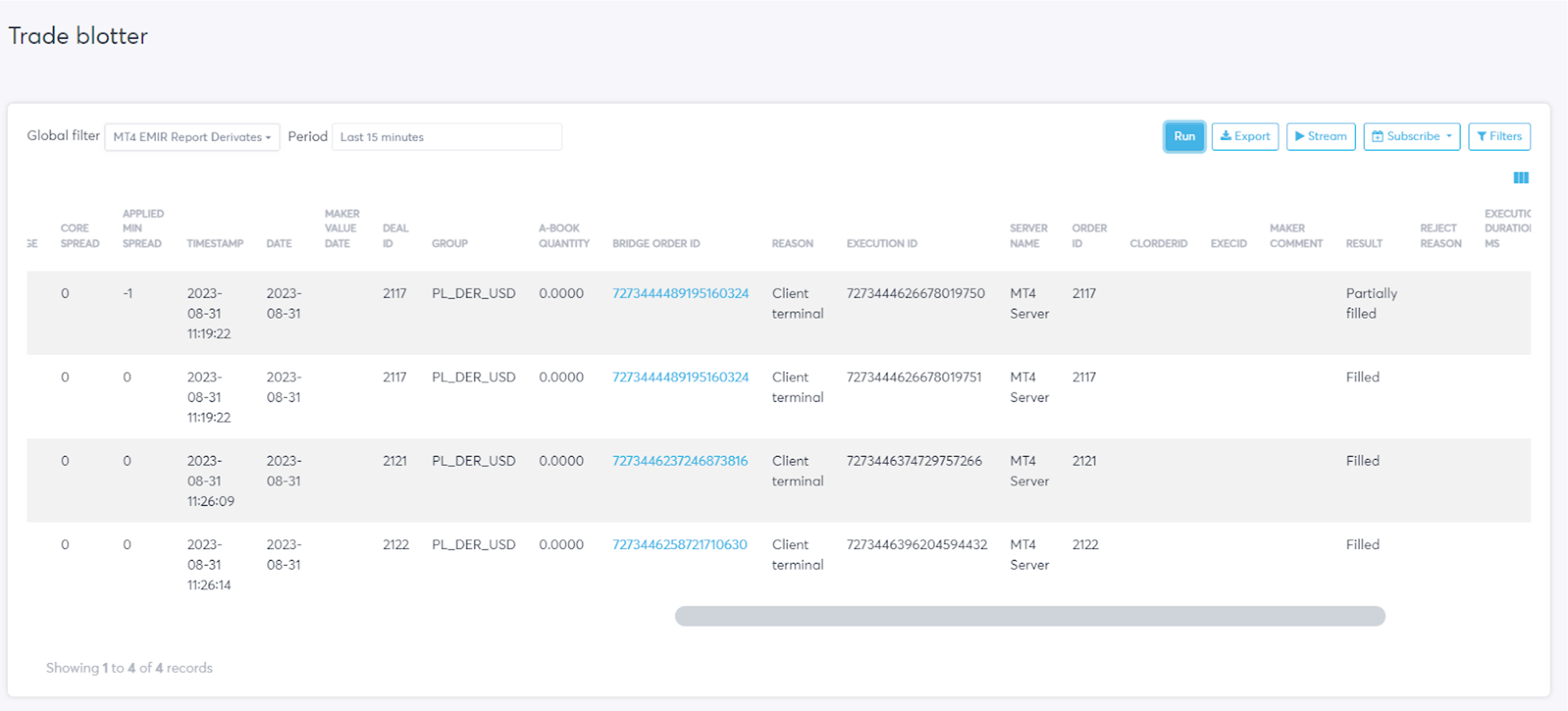

To see how the Global Filter works in Trade Blotter, the broker should follow these steps:

- Go to the Monitoring section and select Trade Blotter.

- On the page, select the Global Filter that he wants to use from the drop-down list, such as “MT4 EMIR Report Derivatives” or “MT5 EMIR Report Derivatives”.

- Click on the Run button.

The Trade Blotter will return all the trades done by the accounts in the selected groups. If a broker chooses to run the Trade Blotter with the “MT4 EMIR Report Derivatives”, it will get the following results:

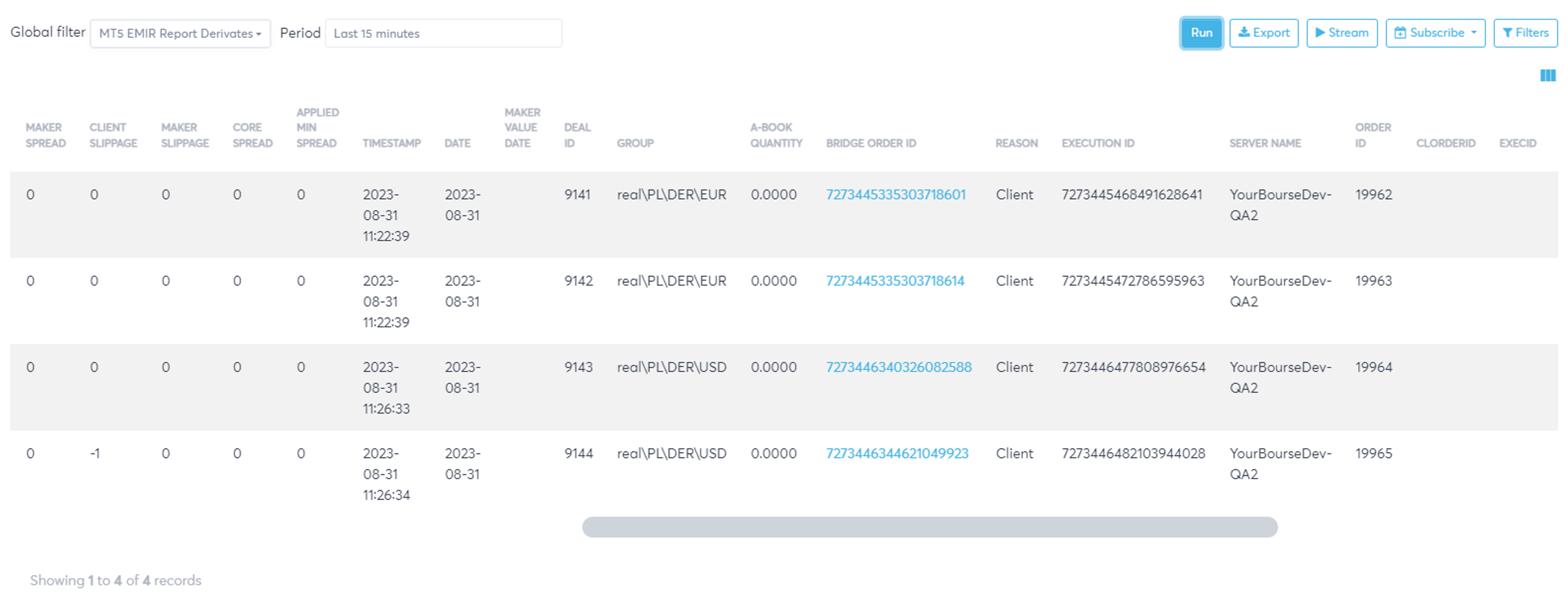

Similarly, if the broker chooses the Global Filter “MT5 EMIR Report Derivatives”, he will get the results for only MT5 clients who trade the derivatives.

Brokers can also mix and match the group filters: for example, brokers can filter by clients who trade derivatives and whose account currency is USD, etc.

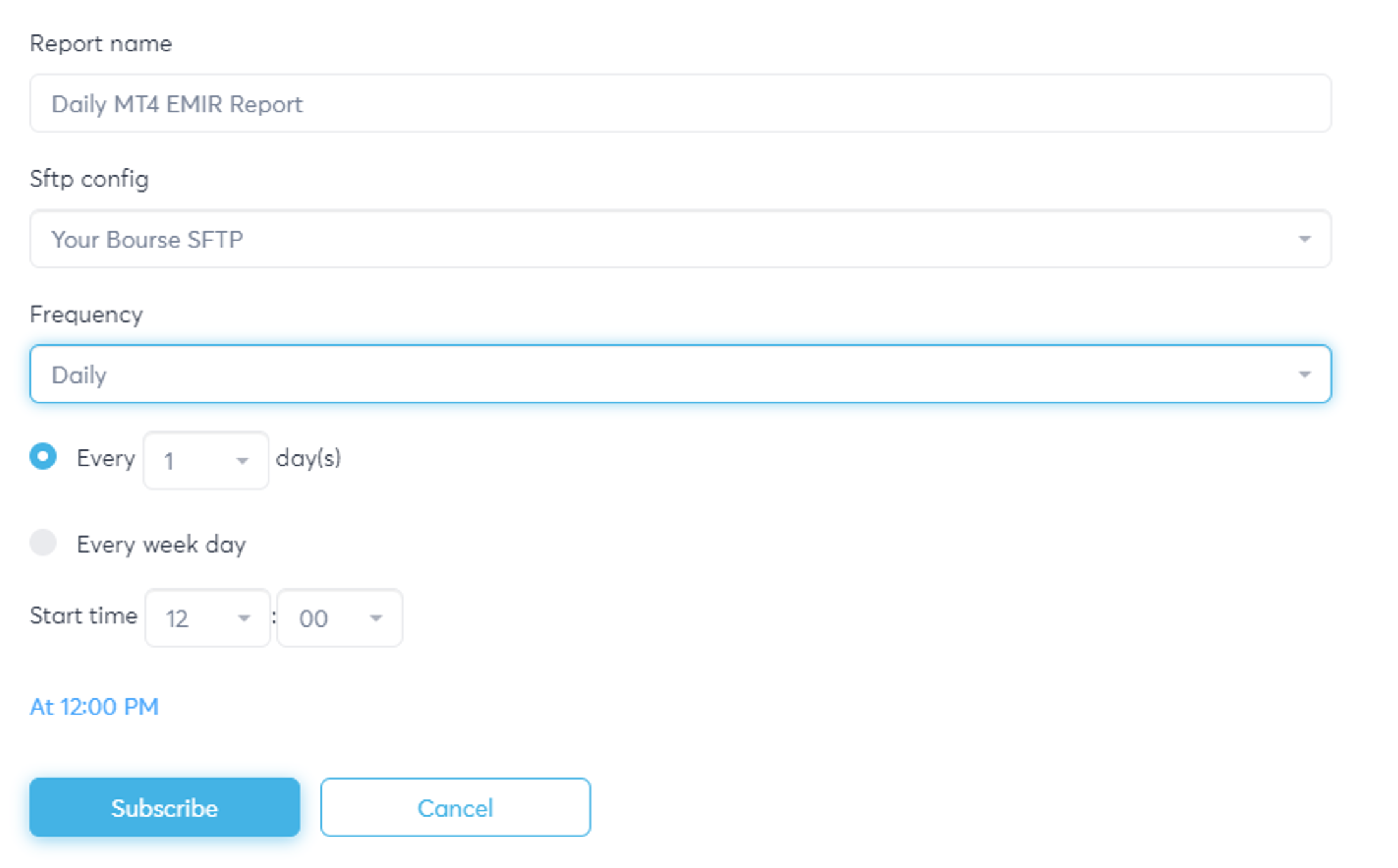

Then, the broker can easily export or schedule this to email or via SFTP this data for the company that helps to prepare the reports for the regulators.

To do so, click on the “Schedule” button in the Trade Blotter and select “Email” or “Sftp”. On the new page, the broker needs only to name the report, choose the frequency for the report, and click the “Subscribe” button.

Upon doing this, Your Bourse bridge will automatically send all the derivatives trades as a report to RegulTech.

Global Filters are one of the many features that Your Bourse offers to its clients to help them optimise their business performance and increase profitability.