Virtual Liquidity Pools To Groups Mapping by Your Bourse: Customized Trading Conditions and Risk Management Made Easy

Your Bourse has introduced a new feature called “Virtual Liquidity Pools To Groups Mapping”. This parameter allows brokers to establish a direct connection between specific MetaTrader groups and designated Virtual Liquidity Pools. By doing so, brokers can execute trades exclusively with particular Liquidity Providers (LPs), resulting in customized trading conditions and enhanced risk management.

To understand the significance of this parameter for clients, let's delve into the challenges brokers often face. Some brokers typically work with multiple LPs from which they source pricing and send trades on behalf of their clients. However, there may be instances where brokers desire different pricing and trading conditions for the same instrument from other LPs. This is where “Virtual Liquidity Pools To Groups Mapping” proves invaluable.

At the core of Your Bourse's cloud-based infrastructure is the Matching Engine, which aggregates symbols from various LPs and transmits them to MetaTrader platforms. Within the Matching Engine, the Virtual Liquidity Pool acts as a vital component that enables brokers to select LPs from which symbols can be aggregated. Brokers using Your Bourse can create multiple Virtual Liquidity Pools and configure them according to their specific requirements.

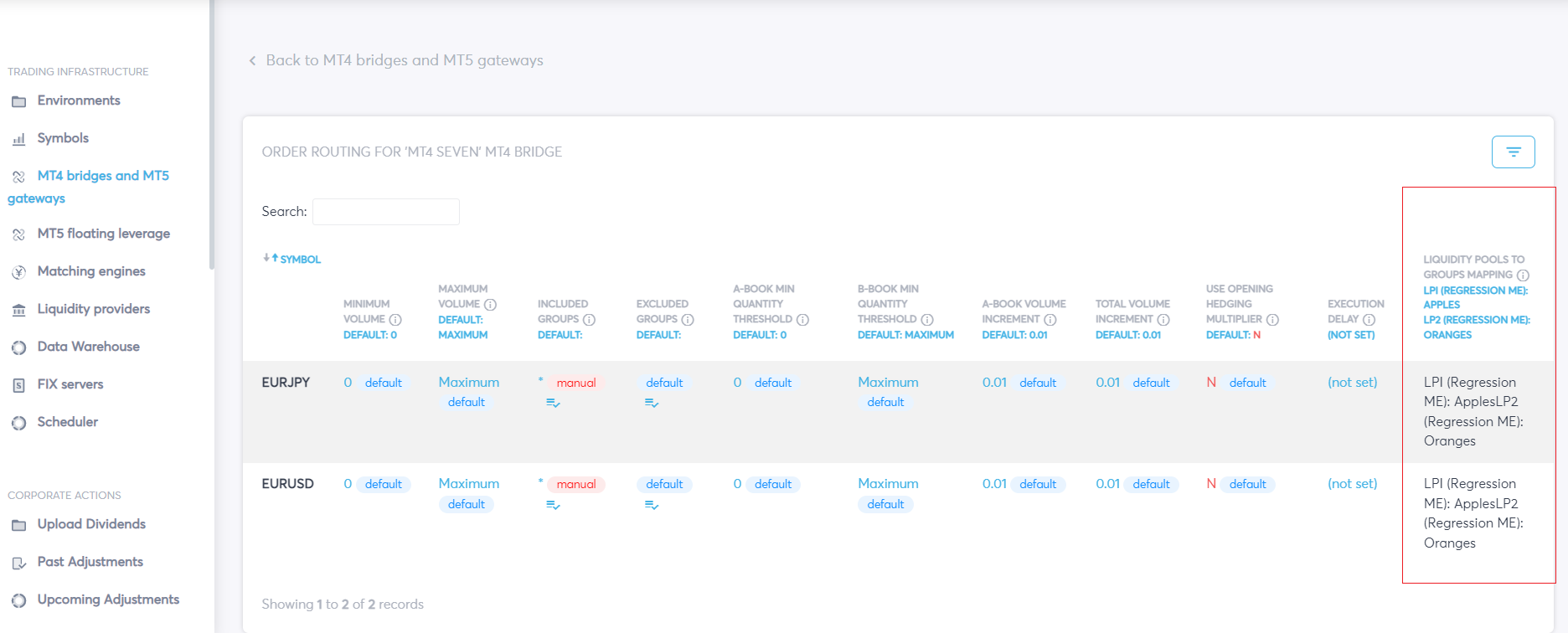

With the VirtualLiquidityPoolsToGroupsMapping parameter, brokers can now connect a particular MetaTrader group to a specific Virtual Liquidity Pool, subsequently directing trades exclusively to a chosen LP for that group. Let's consider an example to illustrate the benefits.

How it works

Suppose you are a broker utilizing Your Bourse's services, and you have two LPs: "Red" and "Blue." Due to the pricing policy of the Red LP, you incur higher costs for its services compared to the Blue LP. For the EURUSD symbol, you receive prices and execute trades with both LPs. However, by utilizing the Virtual Liquidity Pools To Groups Mapping parameter, you can strategically optimize your trading conditions.

You have two distinct groups on your MetaTrader 4 platform: "Apples" and "Oranges." By connecting the Red LP (the more expensive option) to the "Apples" group via the Virtual Liquidity Pool "M," you can widen the spread by adding markups. This adjustment allows you to generate more revenue from clients belonging to the "Apples" group. Simultaneously, you can connect the "Oranges" group directly to the "Blue" LP using the virtual liquidity pool "N."

As a result, you now have two groups of clients operating under different trading conditions. By leveraging the Virtual Liquidity Pools To Groups Mapping parameter, you can tailor these conditions to mitigate LP risks. This flexibility empowers you to optimize pricing, spreads, and trading parameters for each group independently, enhancing your overall risk management efforts.

In conclusion

The launch of Virtual Liquidity Pools To Groups Mapping by Your Bourse revolutionizes how brokers can manage their trading conditions and mitigate risks. By establishing direct connections between MetaTrader groups and Virtual Liquidity Pools, brokers can execute trades exclusively with designated LPs for each group. This empowers brokers to customize trading conditions, optimize pricing, and enhance risk management, ultimately providing a superior trading experience for their clients.