Simplify your SWAP Operation with Your Bourse's Next-Gen Solutions

Introduction

Details matter when it comes to precise and effortless solutions. One such detail is the management of swaps—fees or credits applied for holding positions overnight. While seemingly minor, swaps can significantly impact a broker's profitability when managed effectively. Here is where Your Bourse’s Swap functionalities come into play.

This article aims to explain Your Bourse's Group Swaps Configuration and Swap Report tools. These features allow brokers to fine-tune swap transactions across different trading instruments and groups. By using Your Bourse's intuitive swaps configuration options, brokers can efficiently manage swaps for individual symbols or entire groups on MT4 and MT5 (MetaTrader) platforms. By having the flexibility to adjust swaps and to import and configure group swaps in a way that aligns with pricing strategies, brokers can ensure consistency across multiple symbols and groups, all while maintaining a cohesive trading environment.

We will guide you through how these tools work, why they matter for your brokerage, and how they fit into Your Bourse's suite of products designed to optimise your trading operations.

Configuring the Swaps Import

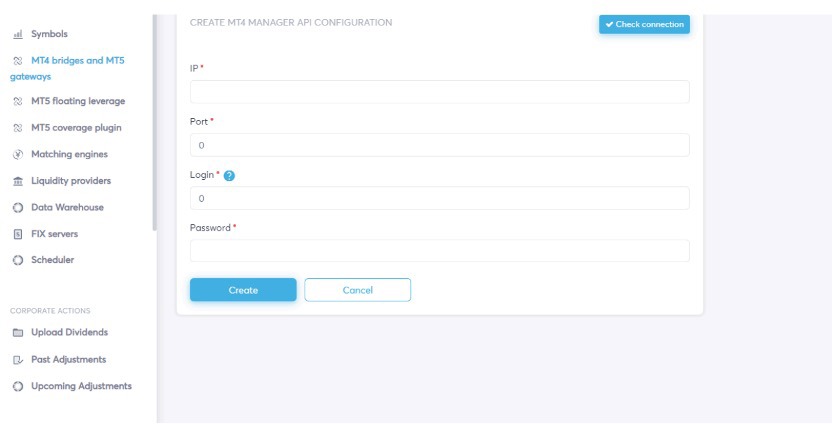

- Setting up the API connection for swaps import is equally straightforward. First, go to "Configure MT4 Manager API" and input the necessary server details like IP, port, login, and password. Next, with just one click, use "Check connection" to ensure a successful link with your server—a green pop-up message will confirm success, so you know everything is working perfectly. Finally, once the connection is verified, save the settings to enable the swaps import functionality. No technical hassle—just a smooth, easy process from start to finish.

How to Use the Swaps Functionality

- Your Bourse provides an incredibly easy-to-use swaps management system that integrates seamlessly with MT4 and MT5 platforms. Managing swaps has never been simpler. First, establish your Manager API connection and select the "Export Swaps" option to download an Excel file containing the current swap values for your symbols. Next, open the file and effortlessly adjust the "Swap short" and "Swap long" columns to align with your desired profit margins. Finally, use the "Import Swaps" option to upload the modified file. Your Bourse will automatically validate and apply these changes to your platform and servers—streamlining the entire process in just a few clicks.

Group Swaps Import

- Beyond individual symbols, Your Bourse makes it easy to manage swaps at the group level, allowing you to streamline the process across multiple symbols and groups. First, simply select "Export group swaps" to download an Excel file that includes all existing group swaps. The file comes with clearly labelled columns for Group (specifying MT4/MT5 groups), Symbol (listing the symbols the swaps apply to, with the option to use "*" for all symbols within a group), and Swap short and Swap long (for setting values for sell and buy positions). Next, adjust the swap values to fit your strategy, whether you're applying uniform swaps across all groups or different values for specific symbols. Finally, use the "Import group swaps" option to upload the edited file. Your Bourse takes care of the rest by automatically validating and applying the changes to your MT4/MT5 servers. It’s as simple as that.

Use cases

- Manage swap charges from liquidity providers. Our tools help streamline the process, allowing you to allocate costs to clients with ease and precision.

- Adjust client swap rates, offering potential for additional revenue. This allows you to customise your pricing structure while maintaining transparency and control.

- Personalise swap conditions for different client groups. With group swaps, you have the option to offer customised rates to specific clients, enhancing the overall trading experience and fostering stronger relationships.

- Support your clients better by providing them with historical information on any swaps adjusted through the Your Bourse platform

To book a demo of this feature and to get in touch with one of our team mates, click here.

Your Bourse Products for Enhanced Trading

We deliver an entire suite of trading technology designed to enhance profitability for multi-asset brokers, liquidity providers (LPs), and crypto exchanges. Our platform is the reliable brain for either retail or institutional brokerage operations. It safeguards you from latency arbitrage, off-market quotes, and challenging traders. It also offers deep insights into and control over your trade flow.

We provide an array of solutions including bridge solutions, liquidity aggregation, and risk management tools tailored for MT4/MT5 and other trading platforms. Our institutional services extend to custom price streams, unlimited liquidity pools, and rapid B2B FIX session setups. With a flexible architecture, five-star 24/7 support, and a 99.999% SLA, we ensure superior performance, scalability, and reliability. Trusted by over a hundred brokers and prop firms worldwide, Your Bourse is a pioneer of trading technology and we’re proud to continuously raise the bar for efficiency and profitability.

Conclusion

In summary, Your Bourse's Swap Report and Group Swaps Configuration tools offer brokers a powerful way to manage and optimise swap operations efficiently. By allowing you to import, edit, and apply swaps across individual symbols or entire groups, these tools enable you to subtly enhance your profitability while providing a consistent trading environment for your clients. Paired with Your Bourse’s suite of products like the MT4 Bridge/MT5 Gateway and Liquidity Aggregation, our technology will undoubtedly set you apart.